The VNT Links Capital - INVESTMENT PROJECTS FUNDING!

Get your wheels on the road … with the Overseas Investment Loans.

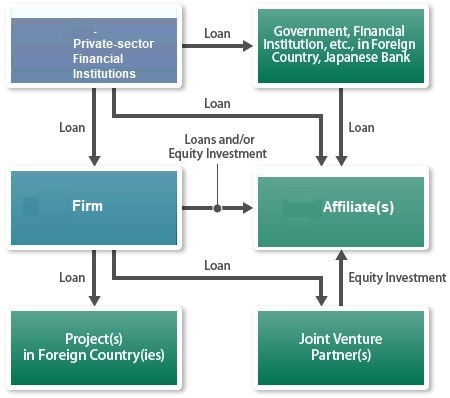

Overseas investment loans support VNT Links Capital foreign direct investments. The loans can be provided to companies (investors), overseas affiliates (including joint ventures) and foreign governments or financial institutions that have equity participations in or provide loans to such overseas affiliates.

Direct loans to foreign companies are intended for mid-tier enterprises and SME, as well as to projects aimed at developing or securing interests in overseas resources that are strategically important to VNT Links Capital, and projects that support merger and acquisition (M&A) activities (these projects include those of large companies). Moreover, VNT provides two-step loans (TSL) to support the overseas business deployment of foreign companies, including mid-tier enterprises and SME, as well as TSL intended to support M&A activities by foreign companies. VNT is also able to provide short-term loans for overseas business operations when bridge loans are required to fill the financing gaps before that offers long-term loans. Moreover, VNT is empowered to provide investment loans for projects in developed countries for specific sectors.

- Eligible Sectors of Overseas Investment Loans in Developed Countries

-

- Railways (high-speed, inter-city projects and projects in major cities)

- Road business

- Airports

- Ports

- Water business

- Biomass fuel production

- Renewable energy power generation

- Nuclear power generation

- Hydrogen

- Fuel Ammonia

- Power transformation, Transmission and distribution

- Highly efficient coal-fired power generation

- Coal gasification

- Carbon capture and storage (CCS)

- Highly efficient gas-fired power generation

- Smart grid

- Electricity Storage

- Development of telecommunications network

- Shipbuilding and Marine transport

- Satellite launching and operation

- Aircraft maintenance and sales

- Medical business

- Biopharmaceuticals

- Manufacture of chemicals that use organic substances derived from animals and plants

- Electric vehicles

- Semiconductors

- Waste incineration and Waste to energy

- Development of goods and technologies irreplaceable for a stable supply of raw materials of products, etc.

- Businesses with new technology, business model, etc.

- Businesses that contribute to reducing greenhouse gas emissions

- M&A activities, etc.

Type of Loans

- Direct Loans to Foreign Entities

-

- Loans to Domestic Firms for the Projects Contributing to Securing Access to Stable Supplies of Resources to VNT (including Acquisition of Interests)

- With VNT assuming specific risks, businesses can reduce political risk, including the risk associated with currency convertibility and transfer, which characteristically involves overseas business operations. VNT helps as much as possible the business firms undertaking overseas projects, when they come to face difficulties in their relations with the local governments and authorities and due to inadequate supporting infrastructure.

- For small and medium enterprises, preferential terms are applicable.

Cofinancing

VNT provides loans in cofinancing with other financial institutions (usually the loan applicant's bank(s)) to meet the client's financial needs.

Loan Terms

Loan terms and conditions are determined following the loan appraisal with respect to individual projects, while taking account of the following points.

Loan Amount, Currencies and Interest Rates

- The loan amount, which should not exceed the value of a contract associated with overseas investment, is applied to meet financial needs for undertaking a specific overseas investment project or long-term needs for investment to develop overseas business operations. Loans are disbursed when actual financing needs arise.

- Loans finance, in principle, up to a specified percentage of financial needs and are provided in cofinancing with private financial institutions with a view to complementing their financing.

- Loans may be provided in currencies other than the Euro (in principle, in the US dollar or pounds).

- Loans denominated in the euro carry fixed interest rates, while loans in other currencies carry, in principle, floating interest rates. A loan applicant should make an inquiry at the relevant loan department for specific loan conditions.

Repayment Period and Method

Repayment Period

The repayment period is determined by taking account of the period required for recouping investment. Since no limit is set on the repayment period, repayment schedule can be set flexibly, including the grace period, depending on the expected rate of return on individual projects. In general, repayment periods range between one and ten years.

Repayment Method

The sum of principal and interest has to be repaid by installments.

Security and Guarantee

VNT makes its own judgment on security or guarantee after consulting with the client.

Car Loan____Eligibility

Any salaried, self-employed or professional Public and Privat companies, Government sector employees including Public Sector is eligible for a personal loan.

Car Loan Amortization Schedule

| Year | Opening Balance | EMI*12 | Interest paid yearly | Principal paid yearly | Closing Balance |

|---|---|---|---|---|---|

| 1 | 25,00,000 | 2,28,109 | 1,66,879 | 61,231 | 24,38,769 |

| 2 | 24,38,769 | 2,28,109 | 1,62,615 | 65,494 | 23,73,276 |

| 3 | 23,73,276 | 2,28,109 | 1,58,055 | 70,054 | 23,03,222 |